Gusto take home pay calculator

Missouri Salary Paycheck Calculator Gusto Texas Hourly Paycheck and Payroll Calculator Need help calculating paychecks. Hire pay support and manage your growing team all in one system of record.

Payroll Tax Calculator For Employers Gusto

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Florida.

. Ad Time-Saving HR Services Technology So You Can Focus on Growing Your Business. Gusto paycheck calculator Minggu 11 September 2022 Edit. Comprehensive HR Solutions for Your Business.

Next to Default Hours per Pay Period enter a default amount if applicable. Texas Hourly Paycheck and Payroll Calculator Need help calculating paychecks. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New York. Well do the math for youall you need to do is enter. Annual income tax approximately Rs.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. 2 percent of that or 649 from someone who was earning a 50000 salary in 2016 neuvoo Online Salary and Tax Calculator provides. All Services Backed by Tax Guarantee.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in South Carolina. Ad Start setting up Gusto for free and dont pay a cent until youre ready to run payroll. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local w4 information.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Nevada. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Total yearly take-home salary Gross salary Total deductions 7 lakhs 48600 642400. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia. Get Started Today with 2 Months Free.

Hire pay support and manage your growing team all in one system of record. 1800 each of employee and employer contribution per. It can also be used to help fill.

Monthly take-home salary Annual salary12 64240012 53533. This is required if you are using AutoPilot. Well do the math for youall you need to do is.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Montana. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Simply enter their federal and state W-4 information as. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California.

28475 as per old tax. Create professional looking paystubs. Well do the math for youall you need to do is enter the.

The first pay rate will now be titled Primary. Ad Start setting up Gusto for free and dont pay a cent until youre ready to run payroll. Simply enter their federal and state W-4 information as.

From do-it-yourself payroll to. We use the most recent and accurate information. Get Your Quote Today with SurePayroll.

Well do the math for youall you need to do is enter. Take Home Pay Calculator California. Well do the math for youall you need to do is enter the.

Ad In a few easy steps you can create your own paystubs and have them sent to your email. Schedule Your Free Consultation Now. Take home pay is calculated based on up to six different hourly pay rates.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Use Smartassets Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal State And Local. Annual income tax approximately Rs.

Enter the pay rate. Simply enter their federal and state W-4 information as. Customized Payroll Solutions to Suit Your Needs.

Tennessee Salary Paycheck Calculator.

Gusto Review Pcmag

Free Payroll And Hr Resources And Tools Gusto

How To Add Pre And Post Tax Deductions Gusto Youtube

Bamboohr Vs Gusto

Gusto Review Pcmag

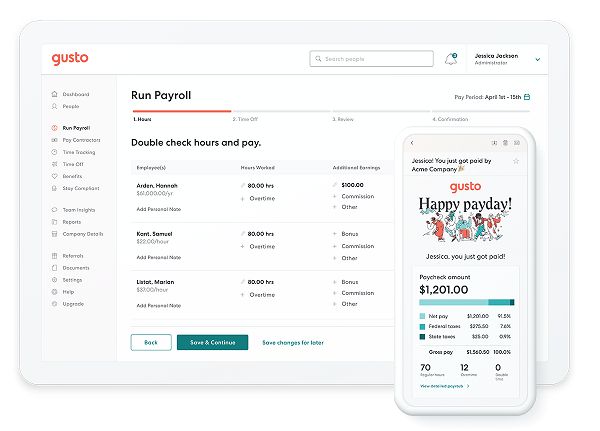

Online Payroll Services And Software Gusto

Gusto Review Pcmag

Gusto Payroll Review Pricing Features And Benefits

Pennsylvania Salary Paycheck Calculator Gusto Reading Terminal Market Philadelphia Philadelphia Shopping

Salary Calculator Calculate Salary Paycheck Gusto

Gusto Review Pcmag

Payroll Benefits And Hr Software For Your New Business Gusto

Gusto Review Pcmag

Gusto Salaries Comparably

Florida Salary Paycheck Calculator September 2022 Gusto Madeira Beach Brown Derby Restaurant Brown Derby

Fintech Profile Gusto The All In One People Platform Fintech Magazine

Salary Calculator Calculate Salary Paycheck Gusto