Tax percentage calculator paycheck

Learn About Payroll Tax Systems. Make Your Payroll Effortless and Focus on What really Matters.

California Paycheck Calculator Smartasset

Your employer withholds a 62 Social Security tax and a.

. Adjusted gross income - Post-tax deductions Exemptions Taxable income. Your average tax rate is. Estimate your federal income tax withholding.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Calculate your take home pay after federal Texas taxes deductions and exemptions. Your average tax rate is.

And is based on the tax brackets of 2021 and. Your average tax rate is. It is mainly intended for residents of the US.

It can also be used to help fill steps 3 and 4 of a W-4 form. If you make 55000 a year living in the region of New York USA you will be taxed 11959. See where that hard-earned money goes - Federal Income Tax Social Security and.

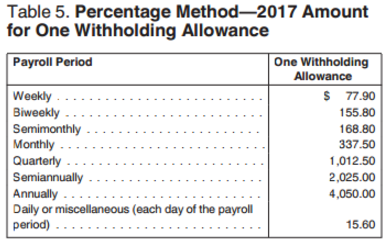

Sign Up Today And Join The Team. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. That means that your net pay will be 37957 per year or 3163 per month.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Over 900000 Businesses Utilize Our Fast Easy Payroll.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Discover The Answers You Need Here.

Enter your info to see your take home pay. Over 900000 Businesses Utilize Our Fast Easy Payroll. The maximum an employee will pay in 2022 is 911400.

Taxable income Tax rate based on filing status Tax liability. That means that your net pay will be 40568 per year or 3381 per month. Taxable income Tax rate.

For annual and hourly wages. Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. See how your refund take-home pay or tax due are affected by withholding amount. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

A total of 24 Michigan cities charge their own local income taxes on top of the state income tax rate. Find your total tax as a percentage of your taxable income. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. Michigan is a flat-tax state that levies a state income tax of 425. Sign Up Today And Join The Team.

Updated for 2022 tax year. Learn About Payroll Tax Systems. SmartAssets New York paycheck calculator shows your hourly and salary income after federal state and local taxes.

That means that your net pay will be 43041 per year or 3587 per month. Use this tool to. Ad Compare Prices Find the Best Rates for Payroll Services.

New York Paycheck Calculator Smartasset

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Taxes On Paycheck Sale Online 54 Off Www Ingeniovirtual Com

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

New York Paycheck Calculator Adp

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Florida Paycheck Calculator Smartasset

Do You Know What S Being Deducted From Your Paycheck Gobankingrates

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Payroll Tax What It Is How To Calculate It Bench Accounting

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Gross Pay Calculator Hotsell 56 Off Www Ingeniovirtual Com

Paycheck Taxes Federal State Local Withholding H R Block

401k Calculator Paycheck Flash Sales 58 Off Www Ingeniovirtual Com

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Understanding Your Paycheck Credit Com